There will never be another startup luxury brand that will reach $1 billion in revenue. In fact, it is very possible that there will not be a fashion brand that was started in the past five years that will reach that level. All of the money invested in (read: spent by) luxury startups to maintain their early growth rate will not drive the returns investors had hoped when they invested huge amounts of money at obscene valuations. Much of this capital will be lost, leaving a general malaise and depression for luxury startups for years. Ironically, these are all positives, and give great reason to be optimistic. The departure of the “me too” investors and hot-air entrepreneurs will mark the beginning of the most incredible time in the history of the luxury industry: a time that will allow forward-thinking entrepreneurs the chance to build bold companies that will define the future.

The Elements of Brand.

A brand is a connection between a business and its customer (my favorite definition of a brand is that it is that first image that pops into someone’s mind when their eyes are closed and they hear your company’s name). In reality, your brand is your business because your business is your relationship with your customer and the confirmation of that relationship is a sale of your product.

Over the past few decades, the global market for fashion has reached hundreds of billions of dollars in size. Because of the immensity of the overall market, specialty brands and retailers have been built in many segments of the fashion industry. As the global fashion market expanded, brands that were more specific to their customers grew and flourished in each of the many segments. By being more specific to their customers’ interests, values and aspirations, the bond and loyalty forged by these brands to their specific segment of customers has been unbelievably strong.

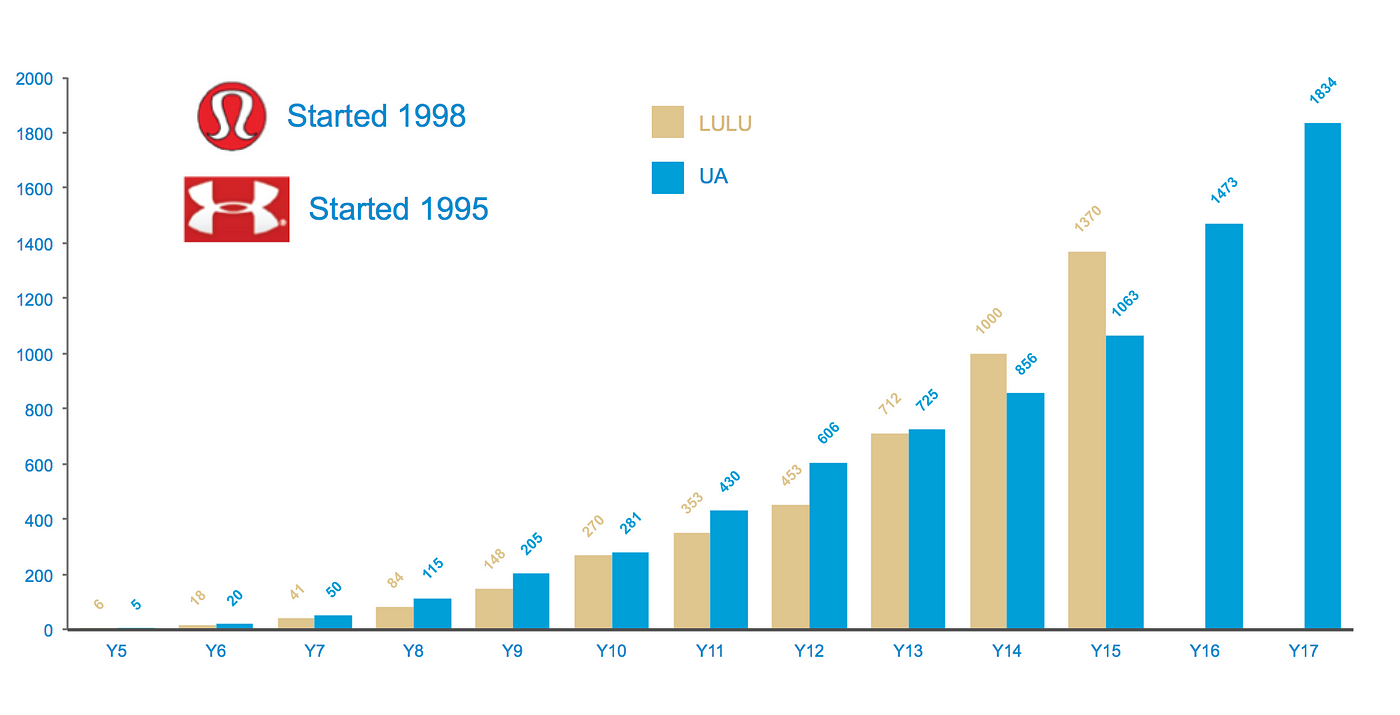

Notwithstanding the transparent-yoga-pants-teapot-tempest and self-inflicted investor and customer relations fiascos a few years ago, Lululemon remains one of the best brands built in recent years, creating enormous amounts of value by cultivating a deep customer connection through specificity in market focus. Since its founding in 1998, it has become deeply intertwined with its customers’ lifestyle and activity. Wearing Lululemon speaks volumes for who you are as a woman — active, engaged, physical, spiritual and connected to your environment; the personification of the Yoga practice. It has grown to be a $1.7 billion company that has created $9 billion in shareholder value. Clearly, creating a deep-rooted and personal connection with your customer is valuable.

Lululemon and Under Armor: two great brands that “slowly”

Five years after its founding, Lululemon was a $5 million annual revenue business. (What a failure in comparison to the famous Internet brands that you read about every day!) But in those five years, they refined their brand and message to customers, they learned and perfected the brand experience, they hired people who grew as the business grew who formed the basis of an organizational infrastructure, they learned how to make stuff well and did all the other things that every successful company needs to master if it hopes to become great. In its sixth year, it tripled in size and never looked back. As it spread across North America, customers first heard about it, then yearned for it and then experienced it. Word of it spread from customer to customer. If you were smart enough to recognize that this was a budding juggernaut and wanted to compete head-to-head, you needed a lot of capital, stores, and a five-year learning curve.

The Internet Changes Everything.

With the Internet, you are no longer constrained by geography or capital to reach your customer. Given the economics of the removal of these constraints, one can build a business that is really specific to a very specific group of target customers and not have to worry about there being enough of them in a given geographic location.

The future will be about specific companies addressing specific markets

All brands will start with the Internet as its central nervous system because it provides the ubiquitous and omnipresent platform for this deeper and more intense relationship. The emotional appeal of a brand that is incredibly specific to you is akin to the feeling of finding your soulmate — who could have imagined someone knowing me so well! Like any passionate relationship, one is consumed with this newly found connection. The ability to be specific stems from the freedom of physical constraints.

The Internet has also provided new brands with an incredible opportunity to launch their business at a fraction of the cost and in a fraction of the time it took before. Anyone can launch a business in the next few minutes on a platform such as Shopify (disclosure: Shopify is a FirstMark portfolio company) and thousands (maybe tens of thousands?) of new brands are starting each year because so many barriers to entry like establishing wholesale relationships or opening a store have been removed.

The Internet also provides everyone with incredible market transparency. As an investor, if I want to get a very rough idea of your sales traction and market interest, I only need to look at your Facebook, Twitter, Pinterest, and Instagram following and engagement. I can also use Google to see how much you show up in searches. It’s not exact, but it gives me (and everyone who is thinking about starting a brand) a pretty good idea of where your company is in terms of its growth.

It’s impossible to prove, but I would bet that Lululemon would have started on the Internet first if it were founded today. The history of this new Lululemon, ‘Lululemon Prime,’ might look like this: they make a beautiful product that their customers adore and then scrape together a store on Shopify to sell it. In their adoration, customers scream at the top of their lungs about this incredible soulmate of a brand on Instagram, Pinterest, Facebook and Twitter. Everyone runs online to Lululemon Prime and buys their products. The company grows rapidly, trying to keep the wheels on the car as it screams down the highway. The founder is tied up speaking to the press and at conferences about how brilliant they are and how they have reinvented the fashion industry.

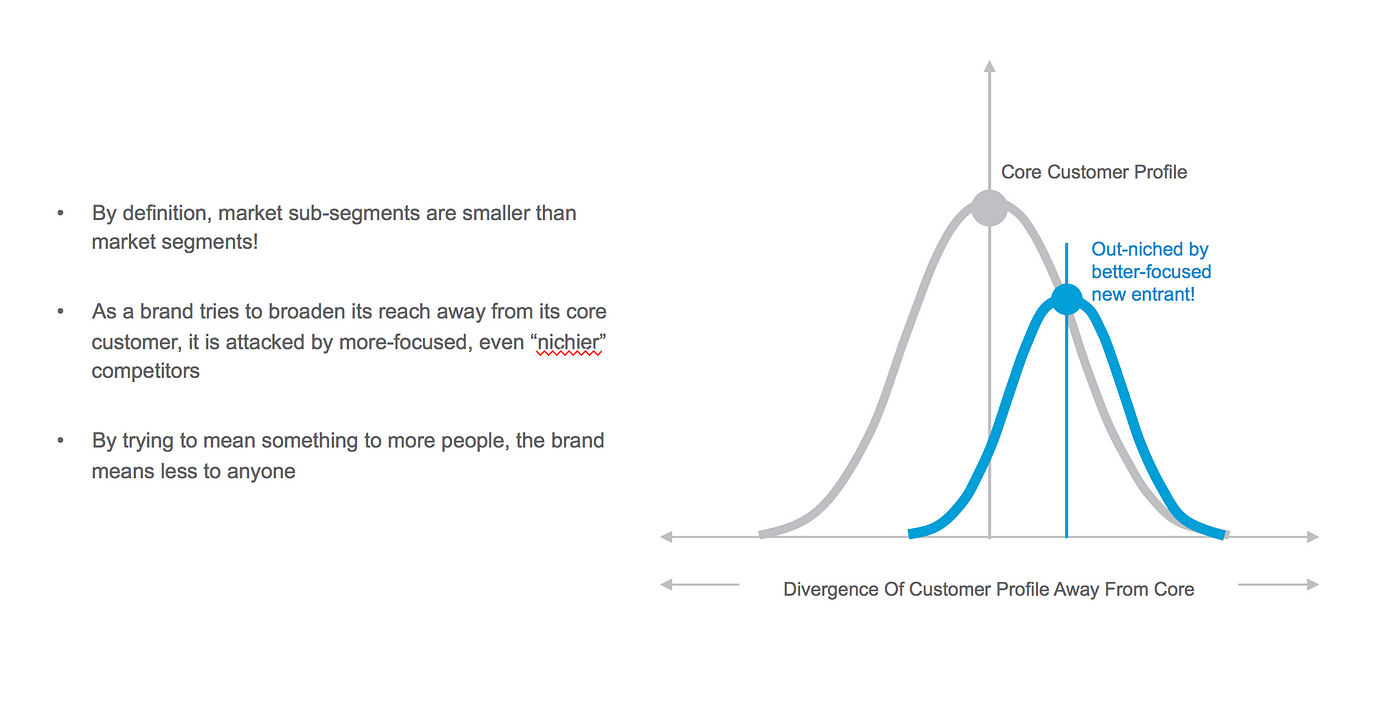

Meanwhile, with all the hype and exposure on this great new company, other entrepreneurs see the gaps that they are missing: the Lululemon for serious Yogis, the Lululemon for women who are a little larger, the Lululemon for women who are a little smaller, the Lululemon for women who want to do Yoga in luxury clothes, the Lululemon for women who practice Hot Yoga, the Lululemon for women who want to only look like they do Yoga, and so on. Each brand addresses a micro-segment of the Lululemon Prime target market, and each one connects better and more specifically than Lululemon Prime because these brands are trying to mean something more to fewer people. As Lululemon Prime adds products and tries to appeal to a broader audience, they begin to mean less to their original core audience because of a diluted message. The smaller, more focused competitors take the edges of their core market by meaning something much more specific and true to their customers. If you don’t think that would happen, a few quick searches on Google turns up more than 100 very specialized competitors in the Yoga apparel market. Really. In addition, you have corporate start-ups like Athleta competing head on and other brands launching competitive lines. Imagine trying to compete against all of that when you don’t have the mass, advantage and dedicated customer base established over 16 years that the original Lululemon has.

The original Lululemon had 5 years to figure out many things. Lululemon Prime would have less than a year. By demonstrating early traction and a very high growth rate, companies have been able to raise a lot of money at a point where their revenue size and growth rate are mismatched to their level of organizational competence and capability. When you don’t have any money, you do things you need to do. You build muscle and strength as you build your team, you learn your customer better and you master the processes that you need to scale. When you have too much money you do things you can do. You hire people who, in turn, hire more people. And all these people have bought into the hype of the mega-valued, social media darling. The science of scaling a business is built upon the replication and amplification of processes that matter. When you have lots of people doing lots of things that may or may not matter, how do you scale successfully? Think of a company as a boat with rowers. Putting too many rowers in a given boat sinks it — putting the right rowers, in the right seats with the right cadence wins a gold medal. Lululemon, had five years to figure it out before anyone really knew they existed. Lululemon Prime would have months to figure it.

The Impact On Investment Returns.

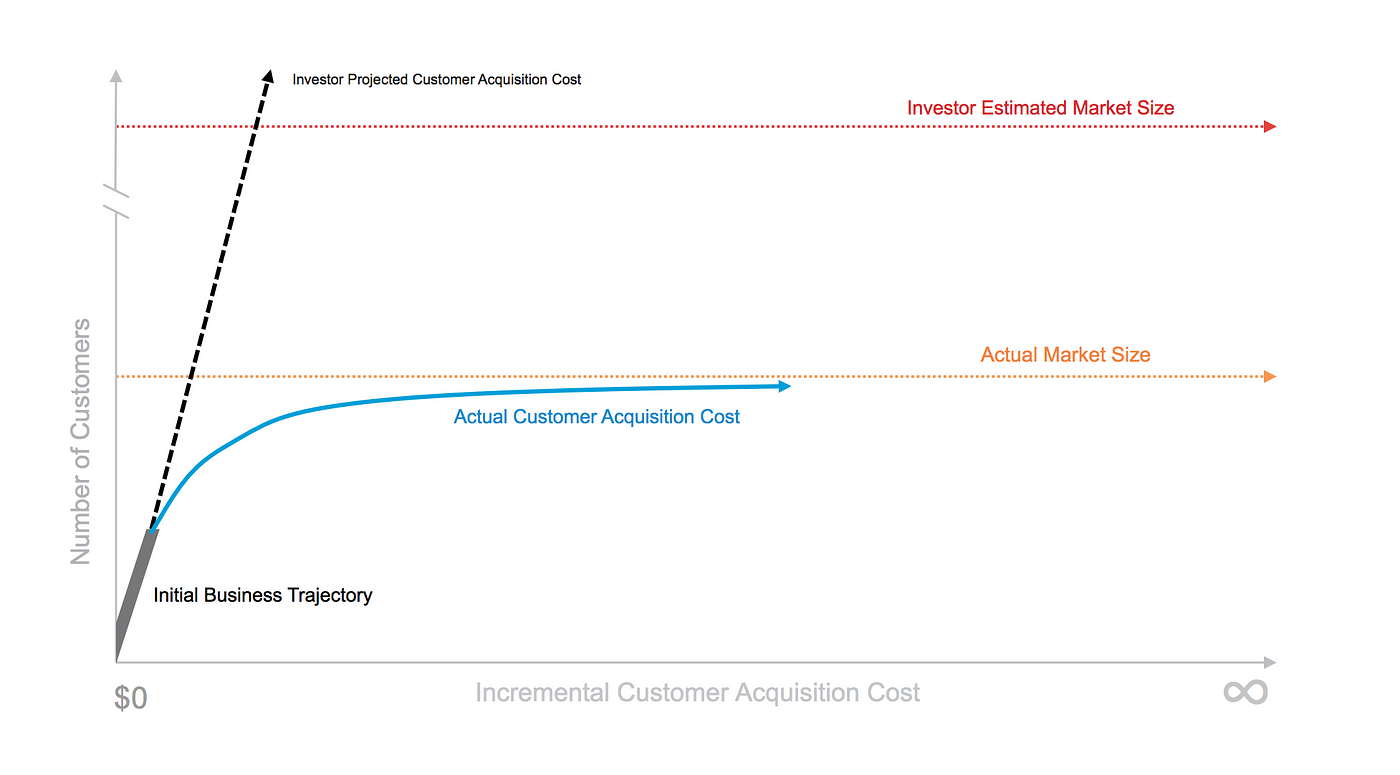

The biggest mistake investors and entrepreneurs make repeatedly is that they infer long-term growth from short-term growth. On the Internet you are connected to everyone so your ability to find a customer is unprecedentedly easy–at first. As with Lululemon Prime, a brand is discovered, customers go crazy on social media, and the company sells a lot of product. The revenue ramp looks amazing, so investors flood the company with money expecting it to continue to grow at that rate. But the company grew so rapidly at first, because it was so specific, and they were able to reach the customers to whom this message resonated perfectly. As the company reaches size, competition and a diminishing remaining pool of potential customers make the acquisition of each incremental customer increasingly difficult and expensive. Revenue then flattens. Investors who thought that this unprecedented growth would go on forever are left with a company that, while meaningful in size, falls far short of the expectations that drove the frenzied investments.

From Lawrence Lenihan

As both an entrepreneur and investor in this market, I have the opportunity to meet with dozens of people each week who tell me that they will be building the next billion dollar company behind the brand that they have created. I’m amazed at the indignation I get when I ask: “What if you have a brand that is only $100 million in size?” The typical response goes somewhere along the line of “Well I’ll show you” (and I hope they do).

But my amazement is not that they think I’m an idiot; rather, it stems from the belief that to them $100MM is a failure or a consolation prize. Who would not want a $100MM revenue company with 20% EBITDA (earnings before interest, taxes and deprecation and amortization) that is making something beautiful and wonderful for a base of customers who would kill for them? At a typical 10x multiple of EBITDA, the company would be worth $200MM. Is this a great return? Sure, if you raised a relatively small amount of money at reasonable valuations. But, not if you raised a lot of money at a high price. For instance, let’s say you raised $200MM at a valuation of $1 billion post-money (i.e. you sold 20% of the company for $200MM). This sounds great because you only gave up 20% for a large amount of capital. Except for one thing — the investors get their money out first in most private company transactions. In this $200MM exit, the investors get all the proceeds because they have preferred stock — and that is in the case of a great outcome! So in the end, depending on how much you raised, there may not be much, if any, left for you despite building a very successful business.

Many startup brands who have had early success have believed that they are worth more than the social media platforms that have achieved valuations of billions of dollars with little or no revenue (another disclosure: my former firm, Firstmark Capital, was a seed investor in Pinterest). What they are missing is that these social media companies are platforms for the expression of millions of opinions while a brand is the expression of a singular opinion. And the brands that will be created from now on will be very specific opinions and must mean something to fewer people than ever before if they hope to achieve success.

We live in an environment where success is measured relatively, not absolutely. Are you successful if you sold your company for $200MM and made $100MM for yourself. Of course, on an absolute basis. But what about compared to those guys who sold WhatsApp for $19 BILLION? A relativist might consider this outcome a failure. So you go for broke and raise hundreds of millions of dollars at billion dollar valuations. But no matter how much you raise, your brand cannot be larger than the size of the market it addresses. We tend to congratulate and celebrate companies who raise a round of financing. Fundraising success does not equate to business success outside of Business Insider or TechCrunch.

The Path Forward.

There might be exceptions to my prediction. I think wholesale-driven brands started by large manufacturing-oriented companies with wide distribution will always be able to create some mass-oriented, license-driven product set to proliferate out in the market (e.g. Jessica Simpson). How lasting brands like that are, though, remains to be seen. Another exception could be where there are finite or proprietary manufacturing or technology resources that are secured. These types of companies are few and far between and the strategies needed to execute will not be available to most entrepreneurs.

I truly believe that there has never been a better time for a modern luxury entrepreneur to build his or her business because so many barriers have been removed. Rather than fight the new laws of the universe that have come into place due to advancements in technology and the ability to access physically dispersed customers, embrace these changes and build a brand that truly connects to a specific group of customers in an intimate and personal way. Will this type of business be a $50MM revenue company or a $500MM revenue company? Nobody knows until you build it. But with the right capital structure, any company that can build a brand that delights its customers can be an economic win as well as a creative win for all involved.

—

Lawrence Lenihan is the founder and CEO of Resonance, an early-stage firm that backs brands in the fashion and luxury spaces. The views reflected here are those of the author and do not necessarily reflect the views of Lean Luxe. This is an edited and slightly rewritten version of a piece that appeared on Medium.

Reporting Queue

-

Monil

-

WhiffSD

-

LeanLuxe

-

-

Monil