Preface: The Reboot is a fun exercise in creativity. In this new ongoing series, we identify market voids and transform brands from mass market operations that mean very little to many, into specialist brands that stand for something compelling and exist for a purpose. First up in the series: Fila.

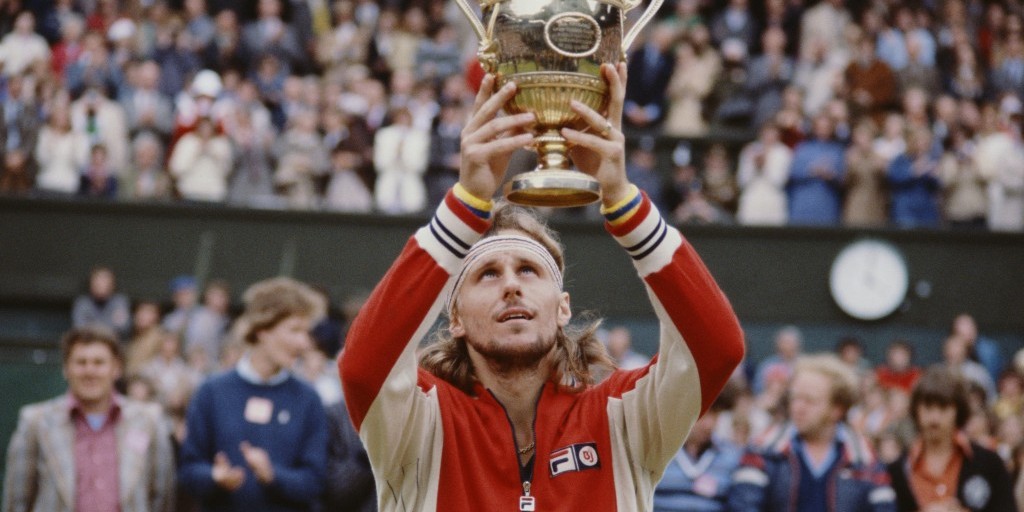

You may not think so by looking at it today, but Fila has tremendous historical pedigree. First started in 1911, this is a company that’s older than Nike, Adidas, or Puma, and it’s a brand originally intended to clothe those living in the Italian Alps. Even if we were to set aside its ties to Bjorn Borg and tennis’ golden era — which we’ll return to later on — this rich heritage involving both Italian and Alpine culture alone (two distinct things) is a real gift that most brands would absolutely kill for.

Fila has this wealth of history in its pocket, but it’s clear they’re not exactly pining to put it to use. Today, they’re stuck with a diluted business model where wholesale and licensees are the money makers. In the US, the brand is overwhelmingly low-end wholesale. Worldwide, there are over 30 licensees, which means that quality and branding standards can vary from place to place.

It’s all very old school, and very much meant for economy of scale. Not least, it’s counterculture to how newer, more nimble brands are finding success today. But given Fila’s erudite sporting history, this proclivity for quantity, quantity, and yes, more quantity, is something of a disservice to the original spirit of the label.

Fila Now.

Despite the Italian name and roots, Fila is in fact Korean-owned, purchased in 2007 by former licensee, Gene Yoon of Fila Korea, for $400 million. Since entering the Korean market in 1991 under license by Mr. Yoon, Fila has found a tremendous amount of success there, and in 2011 the company was healthy enough to acquire, for $1.23 billion, Acushnet, the holding company of several of the world’s top golf brands including FootJoy, Titleist, and Pinnacle.

It bears mentioning, then, that Fila is by no means in financial trouble today, and they’re even running at a profit in the US, according to records. But given the brand’s Italian roots — and its tennis heritage heyday of the 1970s when it had an endorsement deal with tennis legend Bjorn Borg in his prime — it’s regrettable to have witnessed the brand become something of a bargain bin athletic name over the last few decades. Right now, Fila is certainly perceived as such in western markets.

With the rise of activewear, already a $350 billion global market, there’s never been a better time for Fila to reinvent itself for the modern luxury era than right now. Activewear appears to have true staying power, and crucially, it’s a sector that favors the high-end, instead of the low. For a sports brand like Fila with just enough brand equity still left in the tank, this is a godsend of an opportunity, if handled with poise.

The Reboot.

— Fila’s Problem: A storied brand that’s all but lost relevance in a rapidly changing sportswear marketplace. It continues to suppress its rich tennis history.

— Solution: Relaunch Fila as a confident, upmarket activewear label that celebrates both its Italian roots and its tennis pedigree.

— Positioning: The Rapha for the tennis market.

1. Think (and act) smaller.

This is arguably the biggest hurdle for a company like Fila. Their current model — wholesaling, licensees, massive production at the lowest possible cost and at low quality — is undiluted commodity capitalism at its purest. But in order to compete with the likes of Nike, Puma, Adidas, Under Armour, Lululemon and even smaller up-and-coming innovators the likes of Outlier, Caraa, Tracksmith, and Castore, there needs to be a radical and complete internal cultural shift. A reinvigorated culture reliant on real improvement and experimentation would be the anchor for the brand’s success going forward.

Fila would need to think and behave like a new entry and recruit the talent necessary to help them accomplish this. Given their experience in brand building, product standards, and their appreciation for tying in history with contemporary branding, we’d suggest two moves here. First, hire Lean Luxe subscriber Luke Scheybeler as creative director. His involvement in Tracksmith and Rapha, both of which he co-founded, would prove instrumental. Second, commission Partners & Spade for brand identity and messaging. Their track record in working with larger brands like Warby Parker, J.Crew, and Peleton for example, would finely match Fila’s new positioning.

One of the biggest, if not the most essential requirement for the new and improved Fila, would be to start thinking of performance clothing in terms of quality and value for the wearer, which Mr. Scheybeler would have no problem in addressing. In order for these changes to stick, and for more technical innovation to continue pour forth, Fila would need to install a completely new set of R&D and design standards before ramping up in scale to compete with an Under Armour.

2. Completely revamp the product line.

The product line as it stands right now is bloated, and though it would be harsh to characterize all of it as poor, the fact of the matter is that it simply wouldn’t hold up to Fila’s new ambition. So there would need to be both a massive overhaul of the product line and a consolidation in its size. The focus would be on just a few impeccably designed core pieces for the men’s and women’s lines, as well as an increase in price across the board. (Again, bring in new talent if needed, and focus on bringing serious and actual technological improvement to justify the price hike.)

Like Outlier and some of Nike’s special projects, frequent, if not seasonal, updates to the collection might be a good idea here. The new R&D standards mentioned before would ensure that only top notch products and ideas make the cut. The new aesthetic vernacular should be refined, assertive, and confident. It must also be reflective of the Alpine, Italian, and tennis pedigree.

Lastly, scrap the shoes. Right now, 90 percent of Fila’s sales in the US are shoes. But they’re cheaply made, and Nike and Adidas dominate the market on the high-end. It’s an uphill battle to combat that hegemony. Start first with a core of technical and tastefully designed upscale tennis performance clothing, and then perhaps think about getting back into the shoe game.

3. Buy out the licensees.

The licensee model is great for Fila at the moment because it brings in royalties and revenues without the corporate office having to invest much time and money into expanding into new markets. But the downside is that the standards of the branding, the marketing tactics, and the market positioning can vary greatly from licensee to licensee. For the new Fila, that presents a big problem. With uniformity and tight control standards being the new order, it would be best to buyout all 30+ licensees and negotiate the leases on the corresponding retail spaces en route to shutting them down. This would allow for complete commitment on a DTC model (for the time being), and complete control over quality and branding standards.

4. Go all in on DTC.

Like ISAORA did in 2014, pull all the products from the shelves and ditch wholesale. Divert all focus on going direct-to-consumer, and ensure a convenient, enjoyable online shopping experience for shoppers. Instead of relying on 5-15 percent royalties from licensee sales in global markets, making the entire product line available to any consumer in the world from one exclusive online storefront would yield direct sales and much better margins.

5. Redesign the website.

As this will be the new Fila storefront, paying attention to details, both on the front end and on the back end, will be paramount. Truthfully, the current website is not awful, but if going DTC and premium, it certainly needs some work.

6. Modernize the logo and branding.

The current logo brings back memories of the ‘90s when Fila in the US was anything but premium. There’s always value in heritage, but when past missteps damage the equity of a logo and evoke unsavory memories of what the brand used to be, that’s when it’s time to reinvent. So in this case, the logo, in order to break from its discount associations from the past, would do well to go with a more modern refresh that would signal Fila’s new upmarket direction. Incorporate Italy, the Alps, and tennis history. Redo the identity and the tone in a manner that’s fresh for today and aligned with the change in ambition.

7. Focus on Western markets.

In places like the US and the UK, this is well on trend. (The Asian market in general is still undergoing a maturation process.) So to begin, efforts should be focused on western markets, before slowly returning to Asia as the luxury consumer there gradually matures.

Closing out.

This would take a massive cultural shift within Fila. They’d have to go from treating sportswear as a commodity, a cheaply made stretchy pair of shorts or a shirt intended for everyone, to treating of their collection as a closely controlled, quality driven, innovative and premium product not meant for everyone. This is certainly easier said than done. But then again, consider the premium possibilities here for Fila if they were audacious enough to make this transition.

While it’s difficult to estimate what type of revenues this would bring in without access to the company’s financials, it’s not difficult to argue that this would be a sustainable direction for the brand. The quality of the product would be elevated and the standing of the brand would be preserved.

What modern brands would this new Fila most resemble?

Tracksmith and Rapha for their golden-era nostalgia for specific sports; Castore for exciting and vibrant technical focus and confidence; and Lululemon Lab for forward-thinking innovation.