Warby Parker’s only scratching the surface. Here’s what true disruption will look like.

It’s been a big summer for disruption. Since April, Elon Musk’s Space X has landed a rocket on a drone ship in the middle of the ocean , not just once, but three separate times––something NASA has never done in its 58 year history. With Tesla, he’s released a self-driving, $35k electric car, taking in $14B in pre-orders in the process––something GM could only dream of doing. Everything Musk does seems to zip from zero-to-60 faster than anyone would have expected. This is a man who makes the seemingly impossible…possible.

We eyewear industry disruptors could learn a lot from Musk. Because while he’s continued to reach new heights in 2016, the eyewear market has missed the disruption boat. Luxottica and VSP, a vision insurance company, continue their dogged fight to preserve their inflated margins and market share, and they’ve got a fenced-in network of online sales, brick and mortar, and insurance arms that continues to define the operational standards of the industry. As successful as they’ve been over the last six years, new companies like Warby Parker and Zenni are just scratching the surface of the low- to mid-level eyewear market. Their high valuations are indicative of the opportunity at stake, but with Luxottica’s deep-rooted system in place, they’ve yet to steal as much market share as most people imagine.

I agree the industry desperately needs change as Neil Blumenthal and the media have often said — but the story being told is the wrong one. Truthfully, the vast majority of consumers aren’t in a better spot than they were 5 years ago.

Let me simplify what is happening in the industry that I love. The bad guy isn’t your eye doctor or a few big eyewear brands. Rather, it’s a twofold problem: one, an ecosystem controlled by vision insurance plans; and two, the running storyline the most visible new companies have been feeding the press. This storyline gives consumers the illusion of having more choice than they actually do. Both significantly slow the pace of progress. Remember, over 96 percent of eyewear is still sold through the same traditional channels. Here’s why:

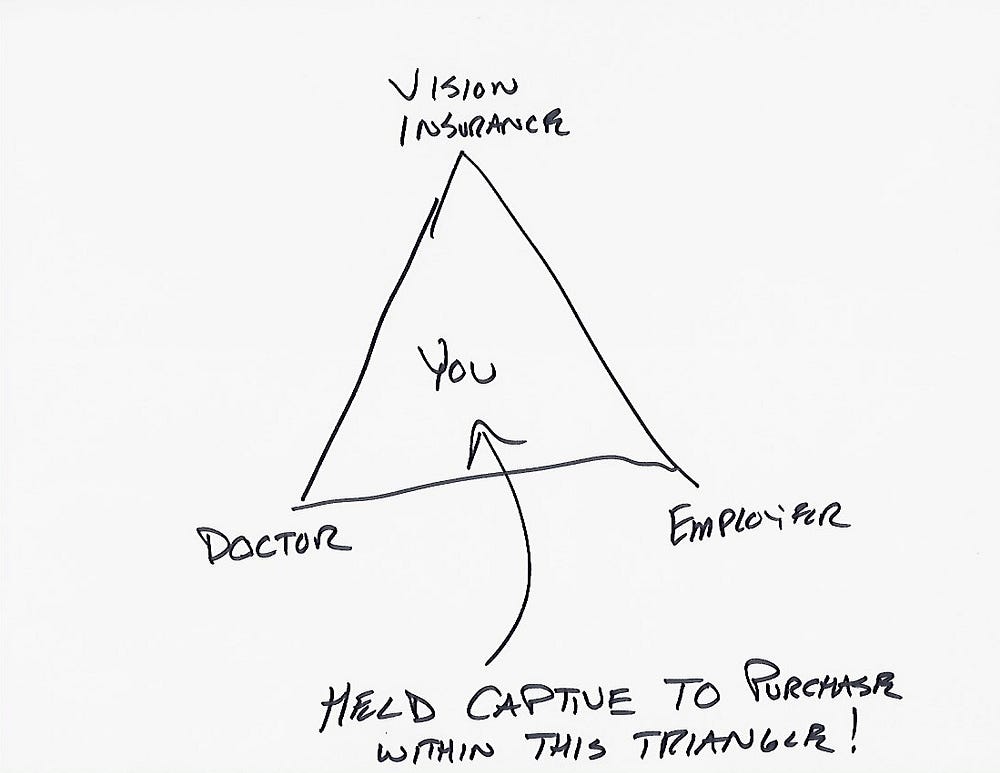

There’s a “Dark Triangle.”

Your employer, along with your vision insurance provider and the retail eyewear brands keep your purchases within what I call a “Dark Triangle.” If you’re one of 121 million Americans with a vision plan, it’s hard to escape from this system because it ties up money that you feel obligated to use. To “maximize” your plan benefit you’re directed to your in-network eye doctor by your plan. Your eye doctor relies on in-network patient flow directed to them from the vision insurance plans. Those doctors are obligated to sell products that are artificially inflated in price to be “discounted” as a requirement by your insurance plan. It may sound somewhat complicated, but the key point to remember is this: You’re trapped in this triangle the moment you, or your employer, commit cash to your vision plan.

In the triangle, you only get to choose eyewear brands that participate.

The Current Disruption Narrative is Weak.

Although heavily covered in the media, Warby Parker still accounts for less than 1 percent of the US eyewear market after six years. It took Apple a year to achieve 1 percent of the handset market with the iPhone. After five, iPhones were over 10 percent of the market. Not to put too fine a point on it, but having the narrative dominated by a single player means that fewer consumers are escaping the “dark triangle” because they aren’t aware of just how many alternatives there are.

Consumers need to be informed of their options — from low end to high end. The vast majority of retail brands — from large to small — design their pricing to sell within the triangle, and consumers won’t forego their vision plan if they’re not aware of the wealth of choices outside of the triangle.

They need to be told the whole story. At that time a tipping point can then happen within the industry and consumers will win. Until then, the “disruption” story will remain a misleading one, and true, transformative change won’t happen.

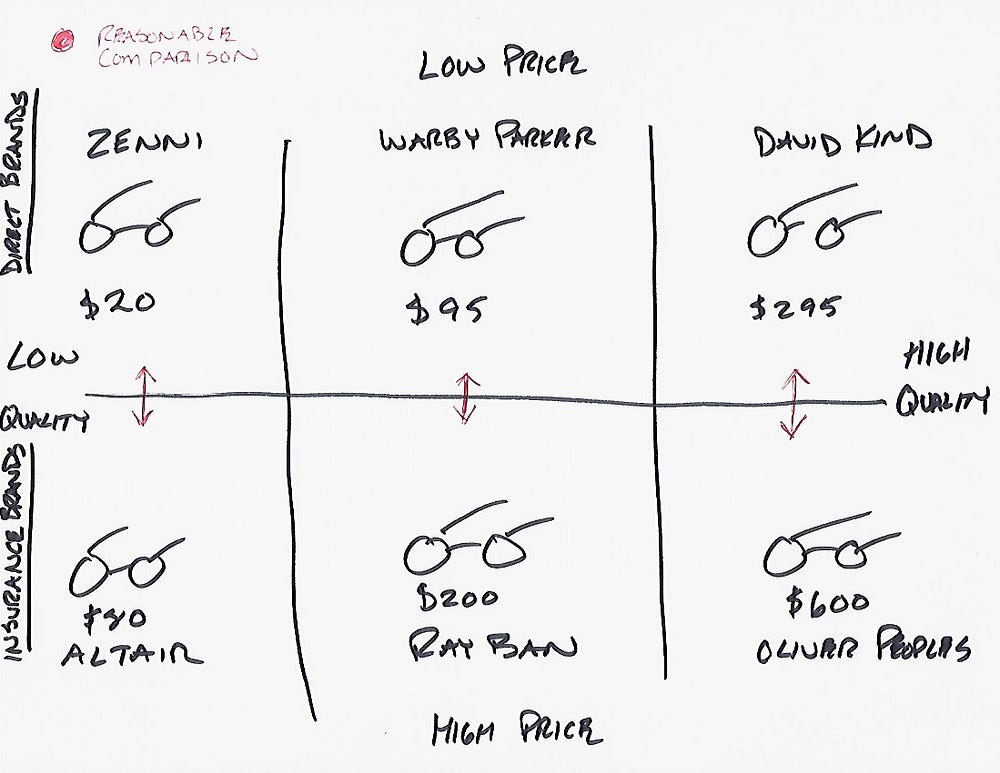

Insurance priced brands vs direct priced brands. MSRP comparison for frames with Rx lenses for comparable product.

Advancing the conversation.

This narrative is causing confusion, and is hindering competition. To push things along, we need to start with a basic question: What’s the “street value” of a pair of glasses? In other words, what’s the full price consumers would have to pay if insurance pricing was eliminated?

To demonstrate, I’ve drawn a comparison between common “insurance priced” brands and “direct priced” brands. By simply removing the fat (vision insurance plan premiums), the price of comparable product drops by 50 percent or more ––or to “street value.” There’s no magic here, just transparency, logic, and math––none of which has ever been presented in any story in any publication that I’m aware of.

In the graphic above, the top row features direct priced disruptors and the bottom row features insurance priced incumbents. It’s a snapshot of the greater market as it’s actually represented.

So how do we increase the pace of disruption? Quite simply, it starts with the press digging a little deeper, and exploring the triangle. Furthermore, the media should shine light on the wider spectrum of businesses in this industry — showing their readers the real choices they have.

We must also help employers offer employees better alternatives to vision plans, like Flexible Spending Account, for example, and access to direct priced eyewear brands. Doctors, meanwhile, should be fairly compensated for services separate from the products they sell. Vision Insurance companies should be shuttered, and those dollars put directly back into consumers pockets to be used to pay fair, transparent prices for products and services.

It’s time a different story is told. One that speeds up the pace of disruption ––or at least running at the proper pace.

—

Dave Barton is CEO of David Kind, an eyewear company based in Santa Monica, CA. The views reflected here are those of the author and do not necessarily reflect the views of Lean Luxe. This is an edited and slightly rewritten version of a piece that first appeared on Medium.